Matthew Montero, Chief Data Officer at Gen Re, is responsible for the execution of their data and AI strategy. His team encompasses all IT-related data practices, including databases, data reporting, data engineering, data science, and AI initiatives.

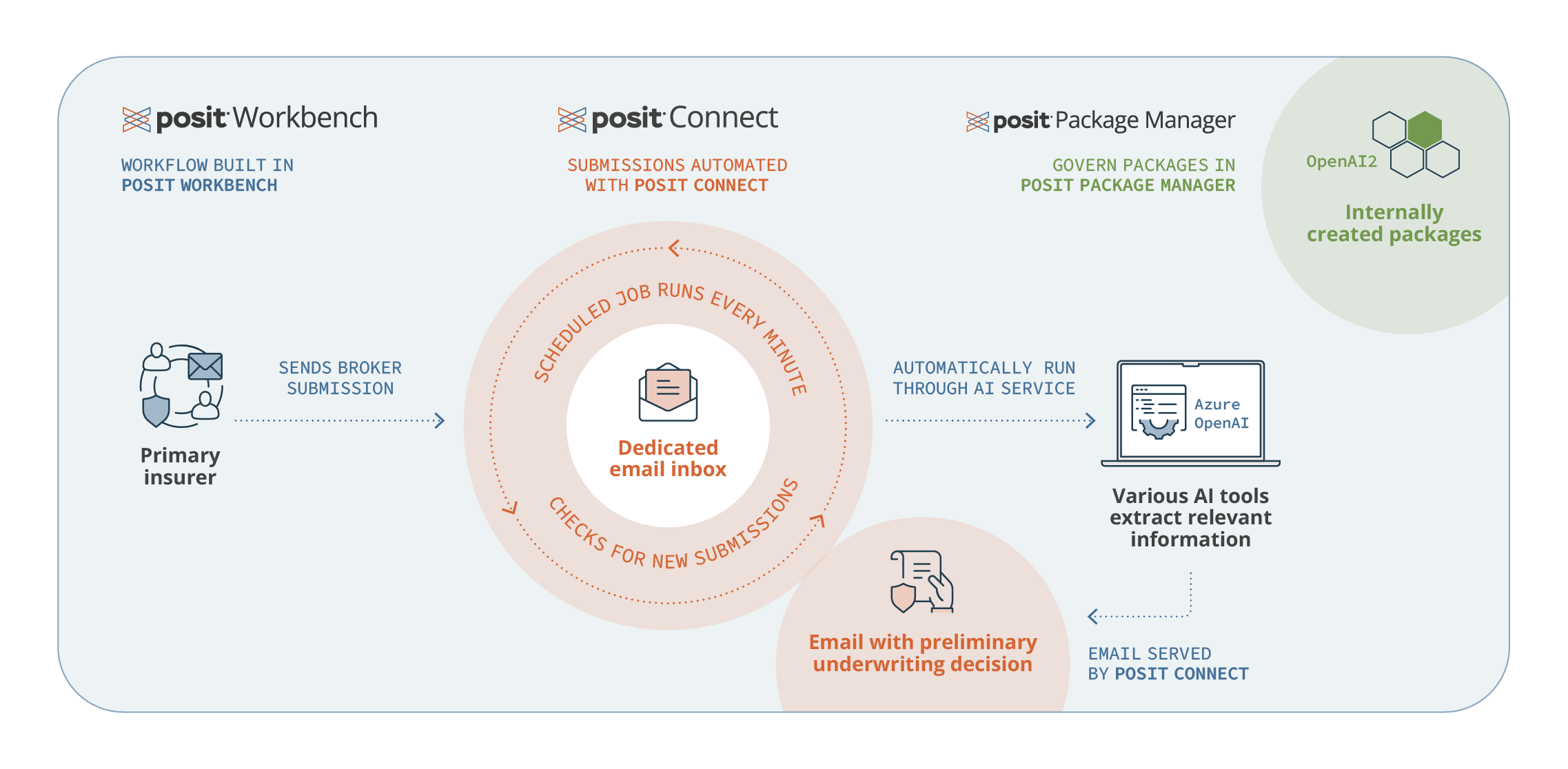

When Matthew joined Gen Re, he observed that data practitioners across departments were operating independently and working with different forms of data, trying to create new solutions for the business. A notable challenge was the absence of a formal, centralized data science platform that offered unified security and data connectivity.

As a global organization, Gen Re must adhere to various laws and regulations, including GDPR, to protect personally identifiable information. Matthew’s goal was to put a system in place with pre-existing guardrails and security measures to enable data scientists to safely build whatever they want and focus on the data science work rather than work extraneous to that. This need ultimately led Gen Re to adopt Posit Team.