SafeAuto is a 700 person, $300M property and casualty insurance company doing analytical work with over 20 product analysts and data scientists. “We tried base R a couple of years ago and found it had a very high learning curve. Then, about nine months ago, I found Shiny, RStudio, and RMarkdown. I was amazed by the possibilities of these products.” This is not how many successful implementations of R and RStudio start, but it’s how John Kish, CIO of Safe Auto Insurance Company, described his journey.

"It’s our data hub. The Posit Professional products give us the security, performance, and administrative enhancements we need to deliver data science applications that our business depends on.”

The Challenge

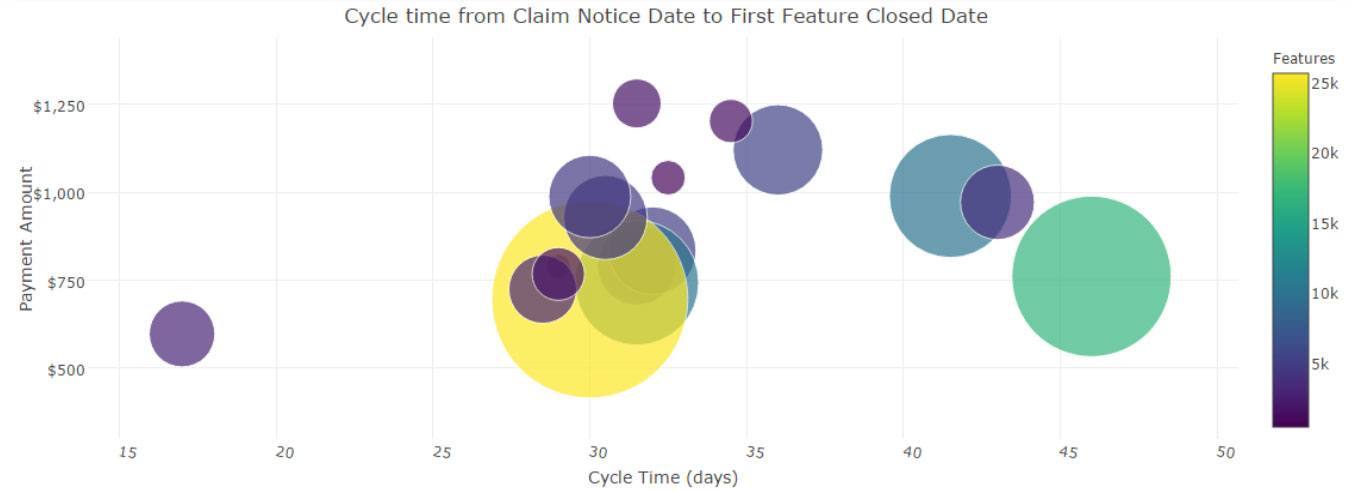

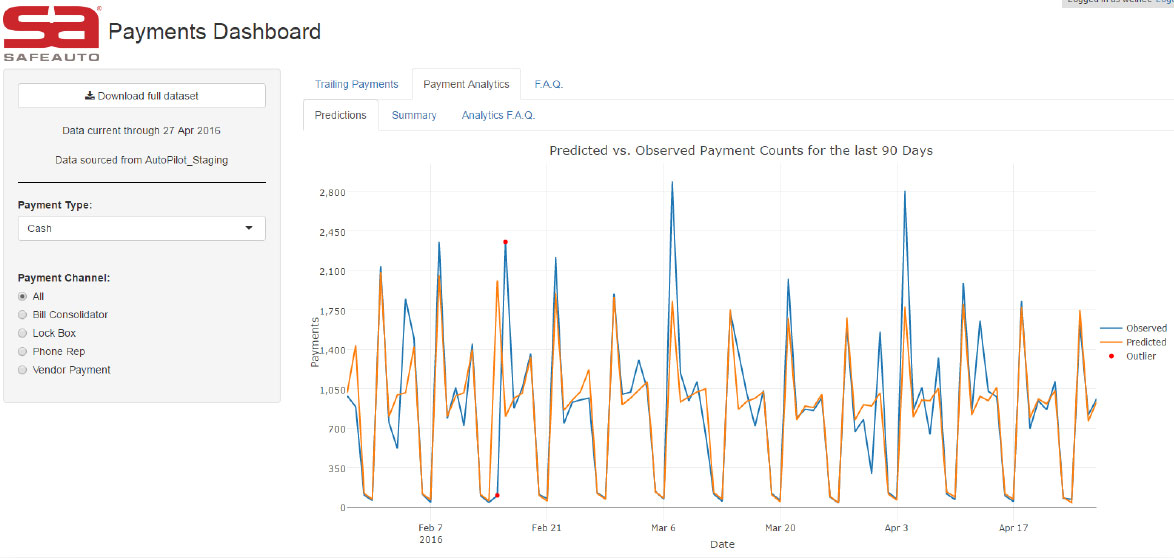

SafeAuto’s goal is to achieve business outcomes by being a data driven organization. “Our ability to quickly and accurately assess business trends at a granular level is one of the most significant competitive advantages we have,” said John. He went on to explain, “First, we need tools that help facilitate the curation and preservation of analytical work with a high level of testability and knowledge transfer. Second, we need to distribute visualizations and models that help tell the stories and fit the problems being solved. Finally, we need our data and analytics to be timely.”

The Solution

After researching many of the market leading products, John and his team found and started to experiment with Shiny, Markdown, and the RStudio IDE about six months ago. He says, “Shiny has genuinely been transformative. As a result, the company has started to change how it consumes data.”

“The Posit products are fairly easy to learn, and offer a level of flexibility and power we feel is needed to advance our analytical capabilities. We also wanted an application with a great support community. R was making inroads into the insurance industry so we decided to take a look,” summarized John. “Historically, we have had some challenges leveraging data within the company. Many of these challenges are not unique to us, but our solution starts with a centralized team that publishes data which is well defined and verified,” said John. “All of our Shiny apps are built with this in mind. We also allow our users to download the dataset directly from Shiny if they want to further explore the data in RStudio or Excel. This way the original data is never in question, and our users can trust the data.”

To get started, SafeAuto created an account on shinyapps.io. This let them create prototypes that could be used to educate others. It also gave them a way to develop analytical skills while building out a robust production environment. They now have Posit Connect configured for 170 concurrent production users and a Posit Connect development and test server.

Shiny is the primary point of access for data at SafeAuto. “It’s our data hub,” says John. “The Posit Professional products give us the security, performance, and administrative enhancements we need to deliver data science applications that our business depends on.”

“We leverage the RStudio IDE for development, and we are currently elevating new code into production daily,” says John. “The RStudio IDE really helps new analysts tackle the learning curve. Additionally, some of the libraries supported by RStudio make the data wrangling and transformation tasks easier than more common tools.”

The Payoff

“The payoff has come through in a few ways,” says John. “First, Shiny helps us automate our data and have results available the next day, or in some cases in real time. Second, the code driven approach allows us to thoroughly test our applications, so we know the applications are correct when we deploy them. Finally, the modeling capabilities are excellent. Once we import and transform the data into R, our ability to model the data in complex ways allows us to quickly ask and answer very deep questions, explore the data, or deliver very sophisticated analysis.”

About SafeAuto

Safe Auto makes it easy to quote, buy and service the right auto insurance at the right price. Founded in Columbus, Ohio in 1993, Safe Auto Insurance Company provides multiple easy ways to reach us that are convenient for the consumer – online at safeauto.com, by phone at 1.800.SAFEAUTO, on a mobile device or, in some states, in-person with a local agent or broker. SafeAuto provides the state required minimum auto insurance coverage for drivers across 18 states so that consumers can get covered and enjoy the road ahead. For more information visit http://www.SafeAuto.com/.