INSURANCE

The future of Insurance is data-driven. Get there, quickly and safely.

AUTOMATED REPORTING

See how Swiss Re automated reporting with Posit

Use cases

Posit helps insurance companies tame the data chaos, so they can deliver clear insights and innovative products and services.

Actuarial Modeling

Actuarial models are essential for assessing financial risk by projecting the impact of future events. Posit helps actuaries overcome challenges with data silos and clumsy legacy tools by providing a modern, code-first environment to build more accurate and easily validated models.

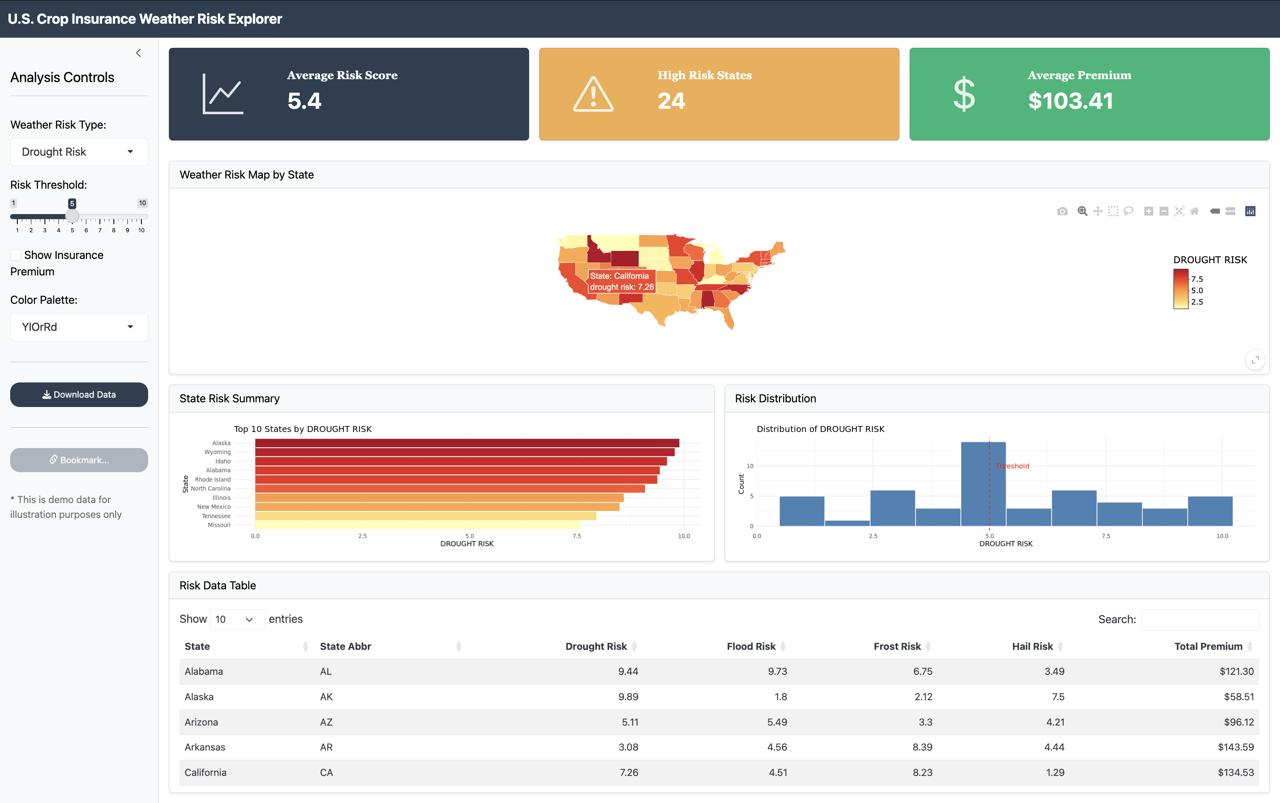

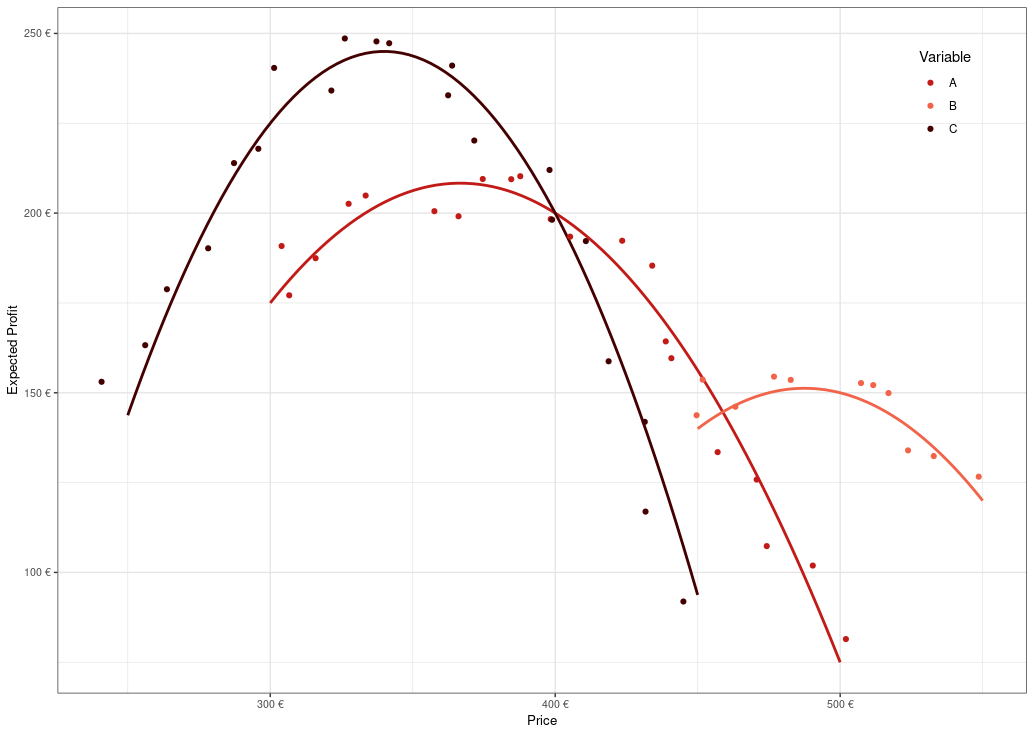

Pricing

Posit helps pricing teams move faster and build more advanced models by providing state-of-the-art, open-source tools for combining disparate data sources and keeping pace with changing market conditions.

Fraud Detection

Insurance fraud costs the industry billions annually through exaggerated claims, staged accidents, and application fraud. Posit helps fraud detection teams automate repetitive data tasks and wield advanced analytical techniques, allowing them to catch fraud faster than fraudsters can adapt.

Key benefits

Posit helps deliver smarter insurance at the right price.

Insurers need to combine vast amounts of data from disparate sources in real-time to accurately assess risk, price policies, and deliver personalized service. Posit helps them access the right data at the right time with state-of-the-art open-source tools for data science.

Delivering insurance takes time and manual effort - to combine and clean data, validate and reproduce risk models, and communicate results to other stakeholders. With Posit Connect, data teams can schedule repetitive, time-consuming work so they can focus on more important work.

There are many parties involved in insurance - actuaries, underwriters, pricing analysts, claims adjusters, fraud investigators, third parties like law enforcement, and many more. Posit Connect helps insurance companies communicate highly customized data-driven insights, quickly and securely.

"Posit Connect met every one of our needs. It allows us to maintain control over our apps, integrate our proprietary packages, and manage access and our users. It also allows us to control our compute resources to better manage our longer-running models. It’s also surprisingly easy to set up."

Partners

Built for Your Data Ecosystem

Success stories

Posit gives insurance companies the ability to build and deliver solutions with cutting-edge open-source technologies.

Gen Re

Gen Re modernized its infrastructure with Posit Team, enabling seamless AI integration and streamlining underwriting workflows to save 600 hours per day.

Generali

Enhanced its pricing methodologies by integrating new data sources related to demand, contract duration, and price sensitivity using Posit Workbench.

Energetic Insurance

Empowered underwriters and other personnel to independently run sophisticated analyses through interactive applications, freeing the data science team for higher-value work.

Resources

Insurance Insights On-Demand

Webinar

How Data Science is Revolutionizing Insurance

Hear from insurance leaders Kshitij Srivastava, Adam Austin, Jamie Warner, and Posit Product Marketing expert Nick Rohrbaugh as they discuss the evolution of data science within heavily regulated industries.

Blog

Five essential models for data scientists in finance

These five models represent a valuable starting point for data professionals entering the financial domain.

Blog

A guide to actuarial techniques in R and Python

Actuaries are using coding languages like R and Python to perform core tasks with greater reproducibility, transparency, and scalability.